Are you a sincere person, or are you as phony as they come?

Most people are pretty good at detecting if someone is genuine or if they are a ‘fake’ person. On the whole, I think that women are better than men at detecting whether someone is genuine or insincere.

In the above paragraph when I use the word, ‘fake’, I mean it in the context that someone is behaving very differently than how they would naturally behave. These fake people often tend to do this in social situations, where they want to project to their audience a sense of enthusiasm. Or, this phony act can be used in an attempt to impress an audience as well.

Unfortunately, the phony person does not realize that most people have the ability to detect this fake behaviour.

Now I could stand to be corrected here, and I would appreciate your comments if you see things differently. I say in the above paragraph that, ‘most people have the ability to detect…fake behaviour.’ I have always been able to detect insincere people, so perhaps it is not ‘most’ people who are able to detect it, rather, ‘some’ people. Either way, I would appreciate some thoughts on this in the comment section at the end of the article.

Since I consider myself to be a very sincere person, and I appreciate the sincerity of others, I have listed below some key points one can adopt in order to become more genuine.

1) Be Real

This is quite simple to do, but many people fail at it. When you are being real, you are behaving exactly how you would normally behave and you are not altering your behaviour in any way. For example, I am a very honest person. When I speak to people I tell them the truth if they ask me a question. I am especially honest if the question is unexpected. This sometimes shocks people, as they cannot believe the answer that I gave them. This is an example of me being real. Me being real here helps to contribute to my genuine nature. If I was being fake here, when a person asks me a question that I don’t really want to tell the truth about, I could lie. Lying in this scenario is NOT how I would normally behave. As a result, people can detect when I am lying here, and at this point, I would come off as very insincere. My honesty in this situation creates a sense of sincerity.

2) When you ask someone, ‘How are you?’ Be TRULY interested in their response

During the course of a single day, have you ever counted how many times you have asked someone, “How are you doing?” If you work with people, then perhaps you ask this question multiple times a day. If you don’t work with people, then perhaps you only ask this question of loved ones and/or family members.

This activity will only work with people that do not know if you are a genuine or insincere person.

When you ask someone how he or she is doing, instead of just ‘going through the motions’ of asking the question, take a different approach this time.

Listen for their response. Keep eye contact with the person. Let them tell you how they are feeling. Process their response.

Then ask yourself, “What sort of energy did that person just project towards me with their response?” Was it a positive, warm energy? Were they upbeat and smiling when they responded, or did they project a negative, cold vibration toward you with their response?

By taking some time to process the energy or lack thereof that they projected towards you, you will now be adequately equipped to respond accordingly.

When I respond to someone, after I ask the question, ‘How are you doing?’, I match the energy, and the energy level that they have projected towards me.

The benefit of doing this is to make the other person feel that you are truly interested in how they are feeling. It makes a big difference, if you take the time to practice this.

Here is an example:

I was out to lunch today with a co-worker of mine. We were at a local pizza parlor, and it was packed full of people! There was a huge lineup to order and the lady working at the cash register looked tired and unhappy with the current state of the restaurant. When we approached the cash register, I simply asked the lady how she was doing. In a quiet, defeated voice, she said, ‘Okay’. At this point, I almost got ahead of myself, and forgot to take the time to listen carefully for her response, and interpret her energy level. I had my mind on ordering my pizza to be frank!

After she responded with the answer of, ‘Okay’ to my question, I took a few seconds, looked at her and said, ‘That is good to hear.’ I didn’t just say this, but I meant it. She could tell that I meant it as well. This brightened her mood and after my co-worker and I placed our orders, she began to talk to and joke around with us, as we waited for our pizza. Her change in mood was significant from the moment we first approached her.

Clearly, by taking a few extra seconds, and listening to her, and matching her energy level, I was able in my mind to project a degree of sincerity, which she appreciated.

Here is the best YouTube clip on ‘being genuine’. This is brought to you by Russ Small, a Calgary Alberta Life Coach. Check him out.

[youtube]http://www.youtube.com/watch?v=hZaZiXXptfo[/youtube]

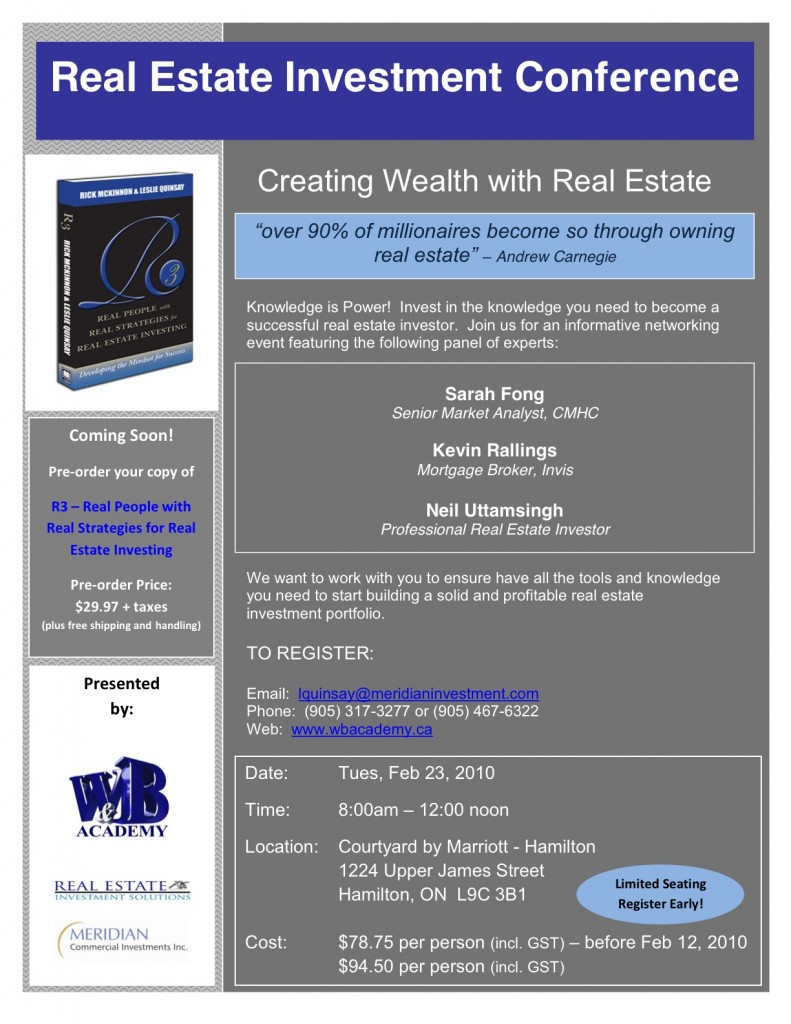

So, how does this all relate to the topic of real estate investment?

I was asking myself this same question, the moment I thought of this article topic.

There is a strong connection between being genuine and real estate investment.

It all comes into play when, as a new real estate investor, you are looking to build your network of professionals around you.

In order to be successful with real estate investment, you need to associate yourself with a number of key people such as a real estate agent, mortgage broker, real estate lawyer and home inspector, just to name a few.

The laws of attraction would believe that you would attract to you those professionals that are similar to you in nature. As such, this could mean that you are drawn towards a real estate agent, mortgage broker, or real estate lawyer with the same values or beliefs that you have. You will be attracted to work with people that you are similar to you in some regard. In addition, you will be repelled away from those professionals that are fundamentally different from you.

So, by being real, as mentioned above, you will project to people the exact type of person that you are. As a result, those professionals that you are compatible to work with will begin to surround themselves around you, and you will begin to seek out those professionals as well.

If you liked this article and are also interested in the topic of real estate, subscribe to my blog.

Best Regards,

Neil Uttamsingh.